jueves, 3 de marzo de 2011

We welcome you all

Come and visit us from MONDAY TO FRIDAY from 5:30pm to on on Arequipa Av. 4545 - Miraflores

miércoles, 5 de enero de 2011

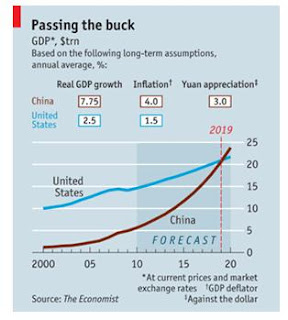

WHEN WILL CHINA OVERTAKE AMERICA?

FORGET Monopoly or World of Warcraft. The Economist’s idea of Christmas fun is

guessing when China’s economy will leapfrog America’s to become the world’s biggest.

The Conference Board, a business-research group, recently predicted that China could

become the world’s largest economy as soon as 2012 on a purchasing-power-parity

(PPP) basis, which adjusts for the fact that prices are lower in China. But economists

disagree on how to measure PPP. And America will only really be eclipsed when China’s

GDP outstrips it in plain dollar terms, converted at market exchange rates.

Since by that reckoning China’s GDP is currently only two-fifths the size of America’s,

that day may still seem distant. But it is getting closer. When Goldman Sachs made its

first forecasts for the BRIC economies (Brazil, Russia, India and China) in 2003, it

predicted that China would overtake America in 2041. Now it says 2027. In November

Standard Chartered forecast that it will happen by 2020. This partly reflects the impact

of the financial crisis. In the third quarter of 2010 America’s real GDP was still below its

level in December 2007; China’s GDP grew by 28% over the same period.

If real GDP in China and America continued to grow at the same annual average pace

as over the past ten years (10.5% and 1.7% respectively) and nothing else changed,

China’s GDP would overtake America’s in 2022. But crude extrapolation of the past is a

poor predictor of the future: recall the forecasts in the mid-1980s that Japan was set to

become the world’s largest economy. China’s growth rate is bound to slow in coming

years as its working-age population starts to shrink and productivity growth declines.

Then again, the relative paths of dollar

GDP in China and America depend not

inflation and the yuan’s exchange rate

against the dollar. In an emerging

economy with rapid productivity growth

the real exchange rate should rise over

time, through either higher inflation or a

rise in the nominal exchange rate. Over

the past decade annual inflation (as

measured by the GDP deflator) has

averaged 3.8% in China against 2.2% in

America. And since China ditched its strict

dollar peg in 2005 the yuan has risen by

an annual average of 4.2%.

The Economist has created an online chart

(www.economist.com/chinavusa) that

allows you to plug in your own

assumptions about future growth, inflation

and the exchange rate. Our best guess is that annual real

GDP growth over the next decade averages 7.75% in China

and 2.5% in America, inflation rates average 4% and 1.5%,

and the yuan appreciates by 3% a year. If so, then China

would overtake America in 2019 (see chart). If you disagree

and think China’s real growth rate will slow to an annual average of only 5%, then

(leaving the other assumptions unchanged) China would have to wait until 2022 to

become number one. Americans would still be much richer, of course, with a GDP per

head more than four times that in China. But don’t expect that to dampen Chinese

celebrations, whenever they come.

Suscribirse a:

Comentarios (Atom)